Home » Report: State’s farmland value dips over previous year

Report: State’s farmland value dips over previous year

February 15, 2019

Farmers National Co. says larger acreage is scarce

The average cost-per-acre of Washington farmland dipped

slightly this year compared to last year, according to a recent land values

report from Farmers National Co.

The employee-owned, Omaha-based company is an ag landowner

services company managing more than 5,000 farms and ranches in 28 states

comprising more than 2 million acres.

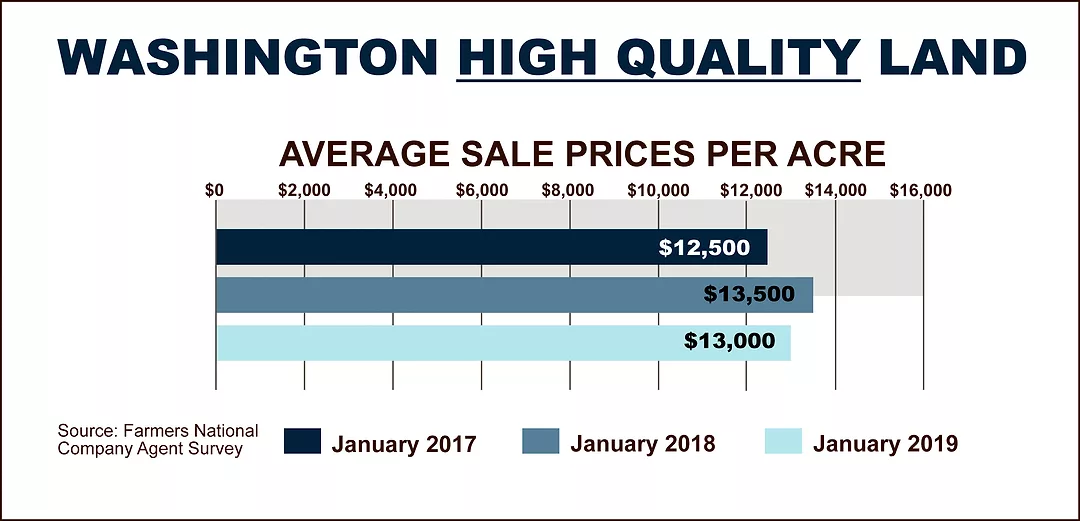

The average sale price per acre in Washington was $13,000 in

January, down from $13,500-per-acre in January 2018. In January 2017, the

average sale price per acre is $12,500.

The major issues for Northwest growers continue to be

immigration and labor, trade and tariffs, and the Farm Bill. Most of 2018 was

plagued by shortages of labor for the labor-intensive crops — asparagus, tree

fruits, vineyards and livestock operations, according to Farmers National Co.

The region is experiencing major reconfigurations of

orchards to get higher production from the same acres. Higher density planting,

re-grafting and total removal of some varieties is taking place, said Flo

Sayre, Farmers National Co. real estate broker based in Pasco, in a news

release.

Lenders are tightening financing requirements more than in

the past and many growers are experiencing a drop in equity as a result,

according to Farmers National Co.

While there appears to be adequate small properties (less

than 20 acres in size) to satisfy the market, larger acreages are scarce and

the values to the grower are far less than the sellers and land owners would

like for returns, Sayre said. Properties in the Basin have ranged from a high

of $18,000-per-acre to other areas that have seen a decline in prices to near

the $10,000-per-acre value. For the most part, prices are at a plateau, she

said.

“Interest rates appear to be holding for at least the next

few months. This is a good sign that stability in the market is at hand. While

not a lot of farmland is changing hands, there is a lot of interest in where

trade issues will head in the future. The land market is leveling off and may

decline a bit more over the next year or two,” Sayre said.

Farm and ranch land makes up 82 percent of total assets for

the industry nationally, according to Farmers National Co.

The company reports an uptick in land sales as more families

and inheritors want to sell, said Randy Dickhut, senior vice president of real

estate operations in a news release.

“Within our 28-state service area, we are also seeing more

landowners coming to us to market and sell their land as evidenced by our

volume of land for sale increasing 21 percent. These landowners are just

deciding now is the time to sell and capture today’s price,” he said.

Overall, agricultural land values have held up surprisingly

well over the past few years despite lower commodity prices and much lower farm

incomes compared to five years ago.

There are a number of reasons for this, including the low

supply of land for sale, cash rental rates remaining stronger than expected and

interest rates that have been historically low, the company said.

But there are some important questions looming about the

land market that are causing many to figuratively hold their breath in

anticipation of what comes next.

“Even

though the rate of bankruptcies and forced land sales is low, there is the

expectation that numbers will increase somewhat in the year ahead as farmers’

cash flows are stressed. There also is an increase of quiet sales to neighbors

or investors where the land is never exposed to the market to see what the true

price is. The ultimate question here is how many more properties for sale can

the market handle before the volume overwhelms the number of buyers and puts

downward pressure on land prices,” Dickhut said in a news release.

Real Estate & Construction Local News

KEYWORDS february 2019