Home » Can you opt out of state’s new Long Term Care Act and tax? Should you?

Can you opt out of state’s new Long Term Care Act and tax? Should you?

May 12, 2021

Washington state has adopted a first-of-its-kind law that both provides a new long-term care benefit and pays for the new benefit with a new tax collected by employers.

Its formal name is the Long-Term Services and Supports Trust Program.

Many employers and employees are scrambling to understand the implications of this new law. This column aims to summarize the new law and provide thoughts on who might want to seek to opt-out of the law – and associated tax.

What’s the tax?

Starting Jan. 1, 2022, employers will begin withholding a new payroll tax from employee paychecks as a premium payment for the new long-term care benefit.

The initial premium rate is fifty-eight hundredths of 1% of the individual’s wages, or 0.58% (RCW 50B.04.070). This amounts to $580 annually for a W2 income of $100,000. But, unlike other payroll tax deductions, there is no cap on the amount of wages that are taxed.

So, if you are making a W2 wage of $300,000, the payroll tax would amount to $1,740 a year.

What’s the benefit?

Under current law, the benefit is approximately $100 a day for up to 365 days, or about $36,500.

This amount is based on the following findings embedded in the applicable law: The average Medicaid consumer uses 96 hours of care per month. The language is embedded in RCW 50B.04.900.

Importantly, the benefit requires work minimums for vesting. In other words, it is only available to those individuals working for wages and paying the tax for the prescribed time. The benefit is not provided if the individual beneficiary moves out of the state of Washington.

Can I opt out?

Employees who can demonstrate they already have long-term care insurance may apply to be exempted from paying the premium, under RCW 50B.04.085.

The application for the exemption is only valid from Oct. 1, 2021, through Dec. 31, 2022, but an employee seeking an exemption must have alternative qualifying long-term care insurance in place before Nov. 1, 2021.

Individuals interested in applying for an exemption should be prepared to act given the short window of opportunity. If you do not have long-term care insurance and choose to acquire it before the deadline, the application process and underwriting might take some time.

The exact form of the application for exemption has not yet been provided by the Employment Security Department. Importantly, if an individual is granted an exemption (opts out) then that individual can never later qualify for the benefit.

Should I opt out?

This is a more difficult question and is highly individualized.

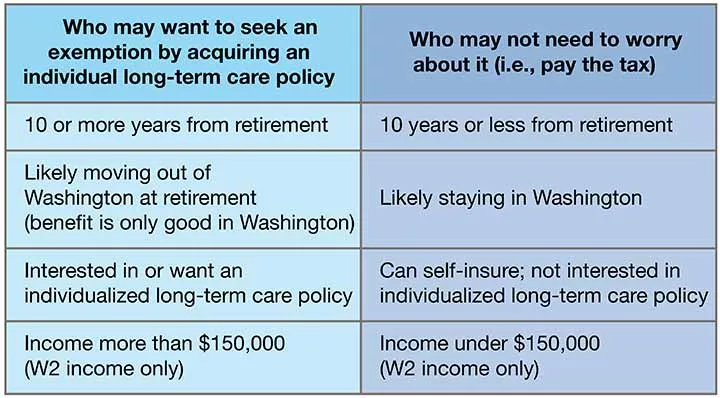

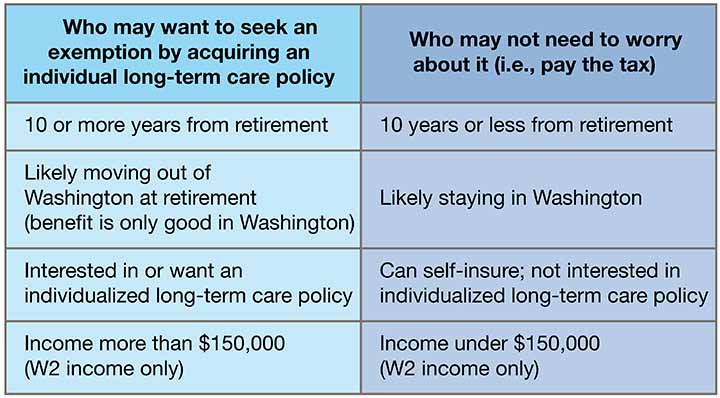

For most people, we think the answer is that you should not choose to opt out. Based on the rules as we understand them, we have put together considerations to help in making your determination.

The longer you plan to work and the higher your income, the more impactful the tax will be on your income. Conversely, the shorter you plan to work or the lower your income, the smaller the impact. If you already have a long-term care policy that is satisfactory to you, then you probably should opt out.

For others, take a look at the following factors in the accompanying chart.

If multiple factors in a column apply to you, it may help determine if purchasing long-term care insurance and opting out is right for you.

This law will impact the vast majority of employees and also the vast majority of employers.

Not only should employees determine if opting out is in their best interest, but the employer also should be prepared to begin payroll deductions in accordance with the new law.

Employers also should provide notification of the impacts of this law to employees as soon as possible so the employee can evaluate his or her options.

Matt Riesenweber, a certified financial planner, works for Cornerstone Wealth Strategies Inc., a full-service independent investment management and financial planning firm in Kennewick.

Local News

KEYWORDS may 2021