Home » Hedging inflation long term: gold vs. stocks?

Hedging inflation long term: gold vs. stocks?

February 14, 2022

There’s no lack of financial press reporting on the effect of inflation on our day-to-day lives. We don’t need to read about it in popular media to feel inflation’s effect each time we fuel up our vehicles, buy groceries for our families, or pay for the variety of goods and services we consume each day.

As a financial advisor, some common questions I receive regarding inflation are about how to deal with the detrimental effects to a client’s portfolio and about how to maintain purchasing power in both the short and long term.

Some of these questions include the following: “What asset classes should I be invested in?”; “Should I sell my stocks?”; and “Is gold the best alternative to cash?” This last question is what the following column will briefly address.

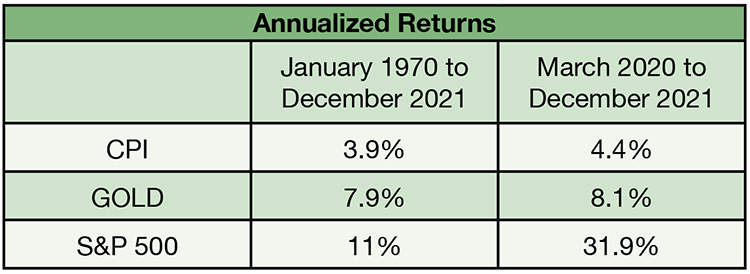

A look at the numbers in the chart will illustrate the difference in asset class behavior between U.S. stocks (represented by the S&P 500 Index) and the spot price of gold from 1970 (shortly before the U.S. unpegged our currency from gold) through 2021.

Stocks returned an average annual return of 11% over the 50+ year period vs. gold’s return of 7.9%, while also experiencing less volatility, as measured by standard deviations of 15.23 versus 19.11.

Is it true that there are periods of time where gold outperforms stocks during this timeframe? Yes, gold has experienced periods of outperformance as compared to stocks, just like other asset classes have.

However, these time periods are usually short lived and the ability to consistently capture those returns by timing those markets is incredibility difficult.

In fact, timing those relatively brief periods of outperformance would be based much more on luck than any acquired skill or knowledge.

On top of that, if someone is purchasing physical gold there are other considerations like storage and insurance to account for, as well as high transaction costs.

Best solution?

So, what is the best solution when it comes to battling inflation over the long term?

I’ve found no better solution than stocks.

As the owner of a stock and therefore part of a company, I’m placed on both sides of transactions: consumer and producer.

Does this always insulate my portfolio? No. Inflation can erode stock performance in the short term, but as a stock investor, my focus is long term, and I can tolerate these fluctuations within market cycles. As business efficiency increases, margins will expand, and my earnings will reflect that in my long-term return.

What have the actual numbers been for the past year? Investors who stayed invested in stocks had a year-end return of 26.9% in 2021, according to the S&P 500 Index.

Inflation was 7%. And gold, well, it returned -4.3%, according to the spot price.

It’s important to discuss your investment strategy with your advisor to find the right mix of stocks, bonds and other asset classes to fit your needs.

A well-designed portfolio is based on a client specific financial plan. If you have further questions, reach out to your advisor for additional resources.

Cory Briggs, a certified financial planner, is a wealth advisor with Petersen Hastings, which has offices in Kennewick and Walla Walla.

Opinion Retirement

KEYWORDS february 2022