Home » Washington ranks No. 3 for best state for small business taxes

Washington ranks No. 3 for best state for small business taxes

August 29, 2023

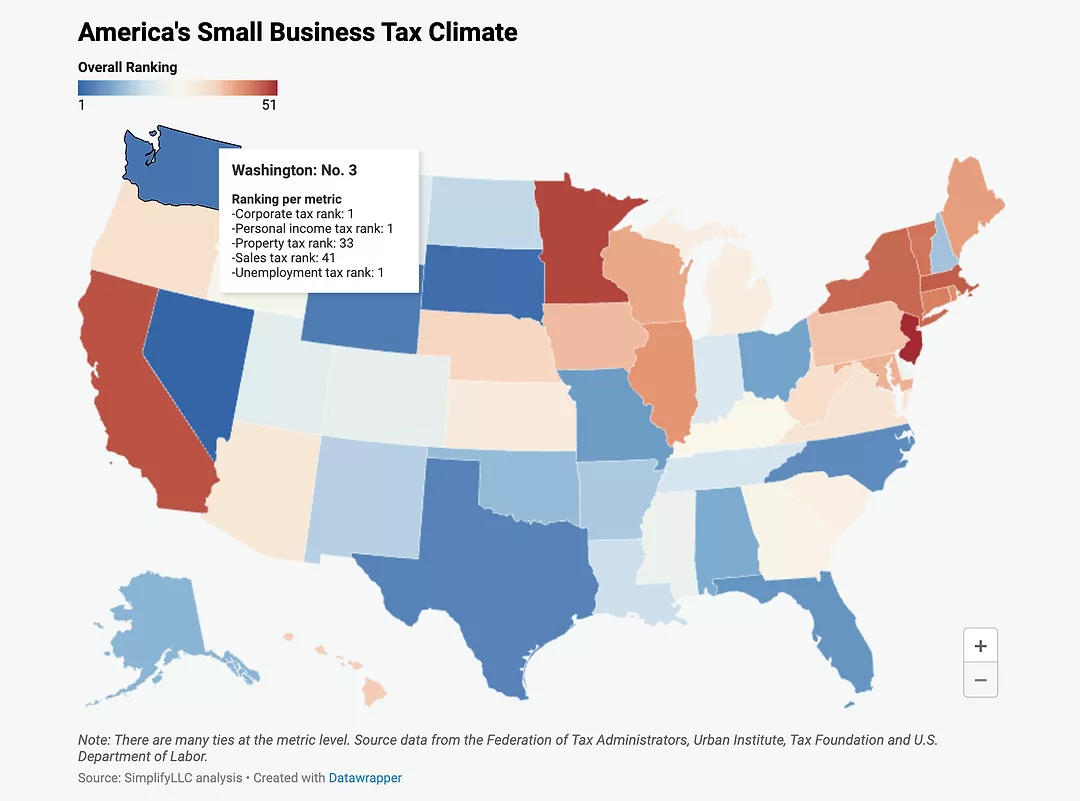

Washington state ranks as the No. 3 best state nationwide for small business taxes.

That’s according to a new study by Simplify LLC, a business consulting company.

To determine which states are the most tax-friendly to small businesses in 2023, Simplify LLC analyzed federal data across five key factors that affect small enterprises: corporate taxes, personal income taxes, sales taxes, property taxes and unemployment taxes.

Its analysis found that states with no or low personal and corporate income taxes are the most tax-friendly for small businesses, even when they have higher taxes for property, sales and unemployment compared with other states.

Nevada is the No. 1 best state for small business taxes, fueled by no corporate or personal income taxes and, along with a handful of other states, the lowest maximum unemployment tax rate at 5.4%.

New Jersey is the No. 1 worst state for small business taxes, driven by the second-highest per capita property tax in the U.S. and high taxes on sales as well as corporate and personal income.

A separate Simplify analysis ranked Washington last in startup survival rate, with 40.4% of businesses started in 2016 lasting five years. Oregon ranked No. 1 on this list with a 58.2% survival rate.

Local News

KEYWORDS august 2023