Home » BPA projects stronger finances, but challenges with cash reserves

BPA projects stronger finances, but challenges with cash reserves

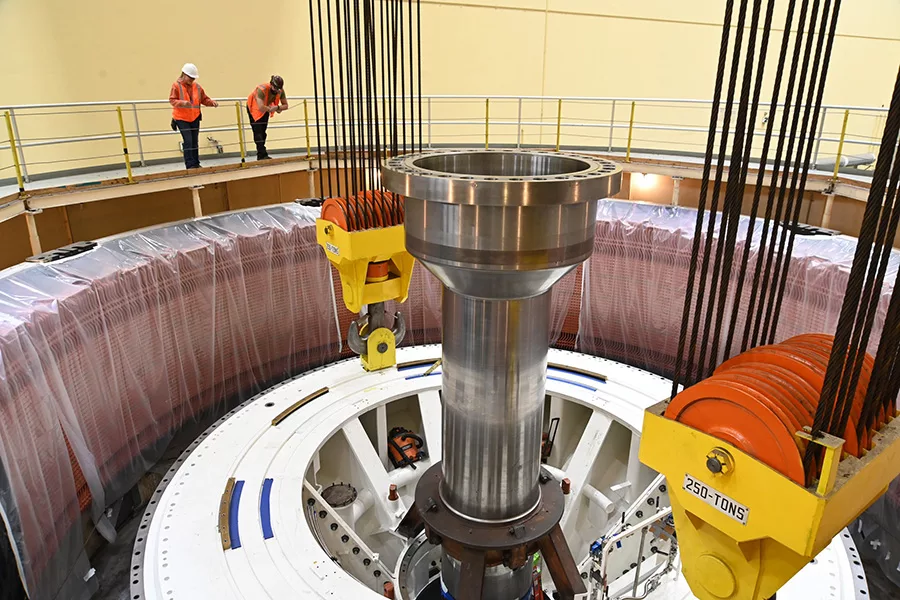

Turbine unit 1 at Ice Harbor Lock and Dam.

Courtesy U.S. Army Corps of Engineers, Walla Walla DistrictFebruary 15, 2026

Bonneville Power Administration officials are feeling more optimistic about the power provider’s finances for 2026 than at this time last year, but still anticipate challenges ahead.

The agency recently presented its first quarter projection for BPA’s 2026 fiscal year. Net revenues are expected to be $21 million below the target of $509 million – primarily driven by a dip in expected transmission services revenues due to customers deferring transmission service requests, according to a release. Power Services is currently on track to achieve its end-of-year net revenue target of $283 million

Chief Finance Officer Tom McDonald in recent comments said factors such as water conditions and market prices may significantly change BPA’s net revenue picture and other financial results before the fiscal year end.

BPA is closely monitoring Power’s net revenues and the variables that may impact it, including snowpack. From a hydropower operations standpoint, while snowpack is well below average in much of Oregon and Washington, conditions are significantly better above Grand Coulee, especially in southeast British Columbia and parts of Idaho and Montana. But there are other possible risks for lost power revenues, such as the outcome of litigation over Columbia River system operations.

When it comes to the agency’s cash-on-hand and reserves, officials are anticipating ending fiscal year 2026 with 75 to 95 days cash on hand, exceeding the target of at least 60 days.

Power Services is estimated to end the year with reserves for risk between $381 million and $442 million, up from $270 million at the end of FY 2025, just above a mandated threshold. Transmission Services is forecast to end the year with reserves for risk between $227 million and $327 million, up from $220 million at the end of the last fiscal year but straddling its mandated threshold.

It was BPA’s failure to meet one of its finance mandates by the end of fiscal year 2025 that will require it to collect $40 million from the utilities it serves via surcharge to shore them up. That was despite the agency ending the 2025 fiscal year with net revenues of $74 million, $4 million above its target and a far cry from the -$44 million projected back at the start of the fiscal year. The federal agency also made its annual $1.2 billion payment to the U.S. Treasury on schedule and in full.

Latest News Local News Energy Environment Government

KEYWORDS February 2026

Related Articles

Related Products