Home » Washington’s Housing Trust Fund explained

Washington’s Housing Trust Fund explained

Here's what to know about the state’s largest bucket of money for affordable housing

April 15, 2024

The state’s Housing Trust Fund has been around for almost 40 years, but recently it’s been top of mind for legislators.

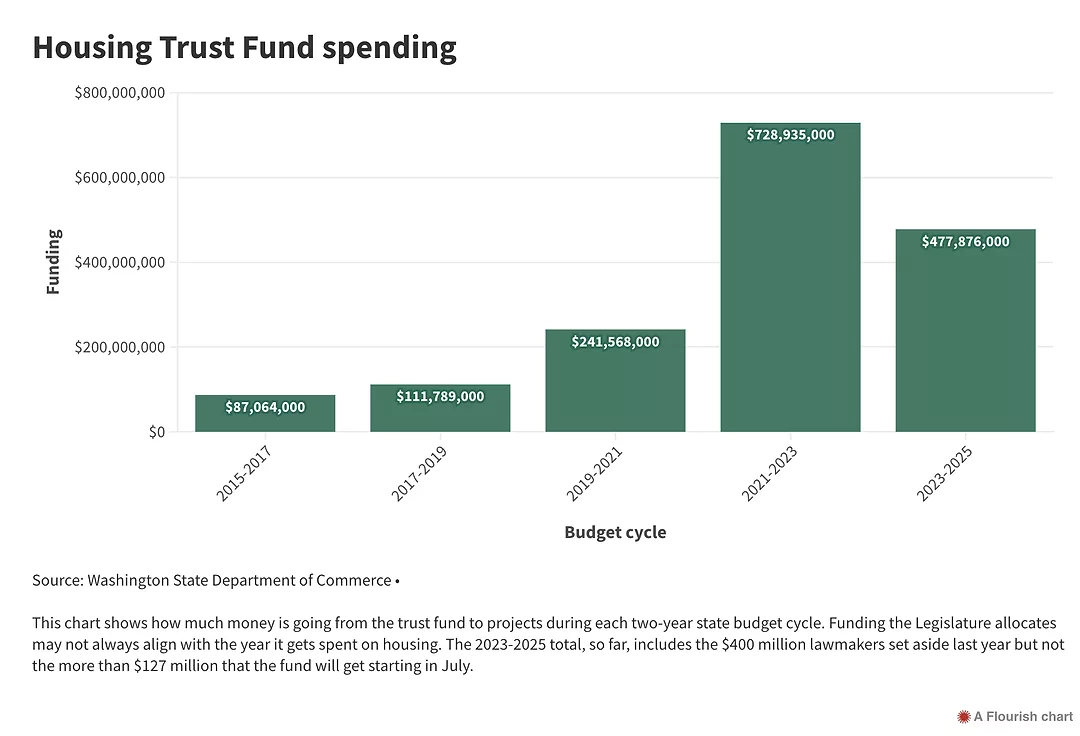

Washington needs more than one million homes in the next two decades, according to a report last year from the state’s Department of Commerce, half of which must be affordable for those with the lowest incomes. The trust fund is the state’s primary way to funnel money toward affordable housing, and lawmakers have been pouring money into it.

Last year, they provided a record $400 million for the fund, spread across various projects and types of housing. This year, legislators followed up with another $127 million infusion.

What does it pay for?

Lawmakers approved legislation creating the trust fund in 1986, envisioning it as a “continuously renewable resource” to help low and very low-income people meet their basic housing needs. Since then, the state has invested about $2 billion from the fund into affordable housing. This money has helped build about 58,600 housing units.

Money from the fund can only go to local governments, housing authorities, some organizations providing behavioral health services, certain nonprofit groups and tribes.

It also must support projects where housing is the main focus, such as assisted living facilities, multi-family rental housing, or homes for low-income buyers. The funding can be used for a number of activities, such as construction, rent subsidies or down payment assistance for first-time homebuyers. Most of it goes to grants for construction.

Projects have to benefit households earning less than 80% of the median income in the area where they’re located and are required to stay in service and affordable for at least 40 years after they’re built.

At least 30% of the projects funded every two years must be in rural areas. In the most recent round of investments, 11 of the 48 multifamily projects funded are located in rural areas. Fourteen are located in King County, and 23 are in other urban areas.

Most of the funding goes toward competitive grants that the Department of Commerce administers, but legislators can also earmark money for specific projects or types of housing.

In the most recent round of funding, lawmakers set aside $19 million for housing for people with developmental disabilities, $20 million for those experiencing homelessness, $13.5 million for acquiring mobile homes and a host of other specific projects across the state.

Funding vs. housing needs

Although lawmakers have increased money for the fund in recent years, demand for the cash is outpacing what’s available.

Last year, 73 projects – both multifamily construction and homeownership opportunities – of the 140 applicants received funding. In 2021, 40 of the 99 projects that applied received money.

To reach the state’s housing needs over the next 20 years, Washington will need to add 55,000 new units every year – half of which must be affordable. Last year, the state was short of that goal by 18,000 total units.

Housing advocates have pushed for a steadier stream of funding for affordable housing through a tax on expensive real estate sales, but lawmakers have not passed that proposal, leaving the Housing Trust Fund as the main source of funding for affordable housing.

This story is republished from the Washington State Standard, a nonprofit, nonpartisan news outlet that provides original reporting, analysis and commentary on Washington state government and politics.

Latest News Real Estate & Construction

KEYWORDS April 2024

Related Articles